Cronos Tests Critical Support at $0.108 as AI Payment Initiative Sparks Developer Interest

Market Pulse

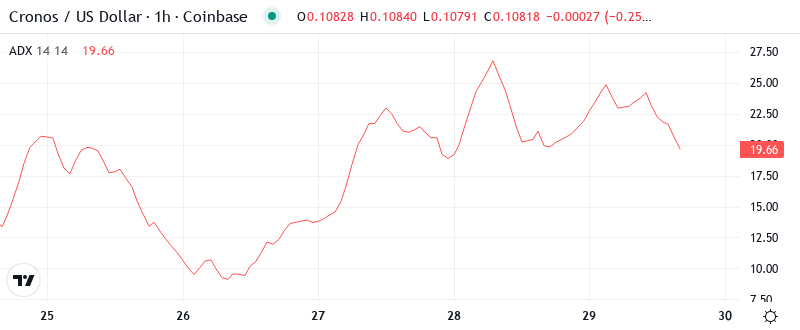

- The CRO price is currently trading flat at $0.108 after a 26% crash in November wiping out gains from late October.

- Price has rebounded from the $0.103 low on November 23, but significant selling supply remains.

- Technical indicators highlight oversold conditions last week, marking the most extended such stretch in about a month.

Cronos is at a crossroads as the price sits at $0.108, essentially flat on the week but off a brutal 26.3% from December’s peak. The $0.150 to current monthly low is the largest drop since spring, removing four weeks from the last three months. CRO has entered a state of excessive sales on several timeframes despite the x402 AI payment hackathon’s efforts to lure developers to the project. For traders, the main concern is whether the $0.108 threshold will become real backing, or if the bears will seek to lower summer’s $0.092 limit.

| Metric | Value |

|---|---|

| Asset | CRONOS (CRO) |

| Current Price | $0.11 |

| Weekly Performance | 9.11% |

| Monthly Performance | -26.27% |

| RSI (Relative Strength Index) | 39.9 |

| ADX (Average Directional Index) | 33.6 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -37.69 |

RSI Drops to 39.91 – First Oversold Signal Since October Washout

With the oscillator still at 39.91 on a daily closing basis, the uptick has not officially started. However, based on prior oversold readings, we can expect a quick move to the 60–70 area, the former highs from August and the last resistance zone before 100. A direct bounce into an overbought condition is rare but preferred.

What is interesting is that RSI reacted on oversold conditions in October – the bottom near 35 was followed by a 40% jump in the following six weeks. Hence, for swing traders, this balanced-to-oversold RSI reading is the first real mean reversion trade since autumn, particularly with the AI payment hackathon potentially adding some new utility demand to the mix.

ADX at 33.6 Confirms Mature Downtrend Nearing Exhaustion Zone

The strength of the trend can be an interesting one and ADX has gone above 33.6 which generally is an indication of strong directional movement down which is also being led mostly by the sellers. This keeps us away from a trading range situation and steady consolidation we’ve seen quite a bit of Q3.

In the past, when CRO’s ADX has gone above 35 in a downtrend, it is often a phase of massive selling that leads to a strong turnaround. Let’s be clear, we’re still bearish right now, but these high ADX numbers with an RSI that has been over-sold is a reason why these counter-trend rallies become more likely. As such day traders need to get ready for potentially bigger volatility as the news continues to be digested on the Smarturn front and with all this new dev activity off the hackathon.

20-Day EMA at $0.114 Becomes First Resistance Target for Recovery

Looking forward, immediate support lies at $0.105, the September low. If that doesn’t hold, prices from the end of August can be found around $0.097 as the next support level. This outsized 17% fall demonstrates Cro’s vulnerability to a sharp revision, as there is little in the way of technical support beneath current prices.

The 50-day ema saturates at $0.114 shortly followed by the crucial 100-day at $0.117. Should CRO break through the 100-day EMA, another resistance level will be met at the $0.120 level. A few cents away from the 100-day is the 20-day at $0.121. The $0.130 level steps in as resistance beyond the 20-day.

Support Architecture Weakens as $0.108 Becomes Last Defense Before $0.092

There are several levels of resistance located between the $0.156 monthly pivot and the previously broken down support level at $0.12, which should create significant overhead supply. The 1st resistance pivot R1 is located at $0.219, but it is far away at the current pace. The 20-day EMA and some general horizontal price memories are around $0.114 which should provide at least a little bit of resistance.

Bulls are now desperately trying to defend the $0.108 support after surrendering the $0.110 psychological level last week. This area has served as a launchpad three times over the last five days, although the recovery seems to be losing traction. A cluster of low trading activity on the volume profile leaves the XRP price vulnerable to a retest of the summer lows of $0.092 if the current support gives way to the sellers.

The market structure continues to display a classic waterfall decline pattern as each successive support level has failed to hold for more than a few days. With the monthly pivot middle at $0.1564 now 44% above current price, the severely oversold conditions are further underscored. The compressed condition, coupled with the hackathon catalyst and the EVM upgrade implementation, set up a scenario where violent upside and downside resolutions continue to grow more likely.

Bulls Need Convincing Close Above $0.114 to Shift Momentum

If CRO is able to recover the 20-day EMA at $0.114 with confidence, the overall outlook changes considerably. In this case, bulls will aim at the 50-day EMA at $0.120, supported by the AI payment ecosystem news and Smarturn update advantage fundamental drivers of on-going demand.

If the $0.108 support collapses, the bearish case activates on high volume. In that case, I would anticipate stops to be triggered into the $0.092 summer lows, likely catching the hackathon fans that scooped the news of the development. A daily close beneath $0.105 would solidify this bearish continuation structure.

Based on the oversold conditions depicted by several metrics and growing x402 project developer fund activity, CRO will likely make an attempt at rebounding to test $0.114 resistance soon, with the overall environment then revealing whether last month’s decline is indeed spent.