Fartcoin Tests Critical Support After 28% Weekly Slide as Traders Hunt for Bottom

Market Structure Shifts Lower

- FARTCOIN declined by 28.5%, finding temporary support near $0.345.

- Prediction markets have shifted to a bearish industry stance, exacerbating the downturn.

- Given current oversold conditions, a short-term balance may be likely.

Fartcoin had a bad week and lost about 28.5%. Prediction markets turned bearish, causing the stop-loss orders to be triggered. This led to the price drop from $0.40 to $0.345. December’s gains were nearly erased and monthly performance is down 5.9%. Traders are trying to figure out if the current price is the new floor for Fartcoin, or if it will likely go down to test the next support level.

| Metric | Value |

|---|---|

| Asset | FARTCOIN (FARTCOIN) |

| Current Price | $0.35 |

| Weekly Performance | 28.50% |

| Monthly Performance | -5.94% |

| RSI (Relative Strength Index) | 57.3 |

| ADX (Average Directional Index) | 25.6 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | 117.58 |

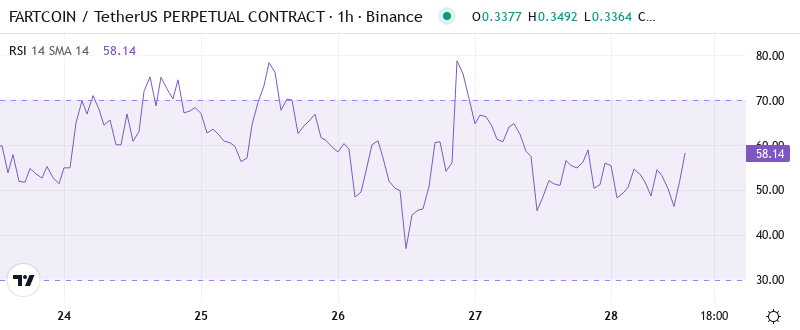

RSI Plunges to 57.3 – Momentum Deteriorates But Avoids Capitulation

When looking at the daily timeframe, the oscillator reads 57.32. This means momentum has cooled quite a bit from those overbought levels, but it hasn’t reached oversold conditions yet. This neutral reading just implies that for the time being, selling pressure has subsided, although buyers haven’t stepped up with much enthusiasm either – in essence, the market is taking a breather from the recent powerful move lower.

What is particularly noteworthy here is that the RSI on the weekly timeframe is reading just 40.24, levels not seen in over a year since the massive rally during April 2020. Such weekly RSI readings have historically been where the largest altcoins and meme coins have bottomed out and gone on to stage relief rallies from. Continuances to such rallies also typically see the daily RSI regain the pivotal 60 mark and hold as support for trend continuation. Hence for swing traders, this equilibrium daily RSI accompanied with the weekly nearing oversold territory suggests staying in cash and being patient.

ADX at 25.64 Confirms Trending Conditions Return After Consolidation

The ADX recommends remaining short, preferably with trailing stops – if you missed the initial foray. Opting for a low-cost hedge in the options market for protection could pay off, potentially exceeding the cost in the P&L of your underlying bearish bets. The imminent panoply of issues facing investors means that anything could happen, so mind those stops this week.

Once ADX declines back below the 20 threshold, the market is expected to start cycling once again. That’s when the overextended price will probably be reeling back in. That daily setup – exploring the new balance area without breaking out – should once again be a high-probability trade to look for. But until this situation arise, we must stick to our mantra and continue to repeat to ourselves: “The trend is my friend.”

20-Day EMA at $0.293 Transforms From Support to Resistance Magnet

The daily column EMA resistance sits way up at $0.476, with the probable final bull/bear line in the sand up at the 200-day, which still trends down at $1.12 and tends to act as a magnet on each bull run. Any weekly closes above the 200 would signal a new HODL phase is likely in play.

A more bearish outlook is given by Bloomberg. As per an analyst working for the agency, Ripple’s XRP is showing early signs of weakness and seems likely to head towards crucial support around $0.2240 if the downtrend is renewed. This would imply a cascade lower, returning price closer to the lows seen throughout 2017 before resistance breaks in November and December last year.

Support at $0.345 Holds for Now as Resistance Stacks Up to $0.402

There are strong resistance levels ranging from $0.365 to the latest monthly high of $0.402 due to longs that were caught in the distribution stage last week exerting selling pressures. The round psychological figure of $0.40 and the longs who bought the FOMO pump seeking to sell at breakeven point also act as resistance.

Looking at the negative side, the current support at $0.345 is the weekly low but was tested only once so there is no solid base for any potential bottom. If the price drops below that, the next noteworthy support is at the weekly pivot of $0.266, which is closely connected to the consolidation area at the end of November.

The current market structure continues to be notably negative as long as the price remains below 0.3650, with new sellers entering the market for every rebound attempt. A long trade setup on the market with a target level of 0.7870 was present during the downtrend, indicating that certain market players are trying to find the low of the move; however, taking a long position on this slumping asset implies employing stringent stop-loss orders, as the charts are starting to look awful.

Bears Control Until $0.365 Breaks – But Oversold Bounce Looms

Buyers need to firmly push above $0.365 in order to make sellers step out of the way, with breakout over $0.40 representing a restart of the uptrend. The next target buyer fresh longs need to focus on is $0.52, but for that, bulls will have to take back control of the 50-day EMA.

If the $0.345 support fails to hold the price and volume pushes it downwards, the price has a clear run down to $0.266, and that will cause weekly pivot to go. If that support level also collapses, stop-losses will be hit all over the place, and we can look for the price to start testing the 100-day EMA at $0.1736.

Considering the weekly RSI and ADX confirming that the downtrend is intact and plenty of room remaining to the downside, the most probable path over the coming weeks will be a slow grind lower to test the December 2018 low of $0.265. The $0.365-$0.385 zone should act as resistance on any relief bounces. Community anticipation is the lowest it has been since inception. Voell’s account removal is bearish given he has been the most effective influencer for the coin. No other potential fundamental drivers are in the pipeline. Sell pressure will continue to grow.