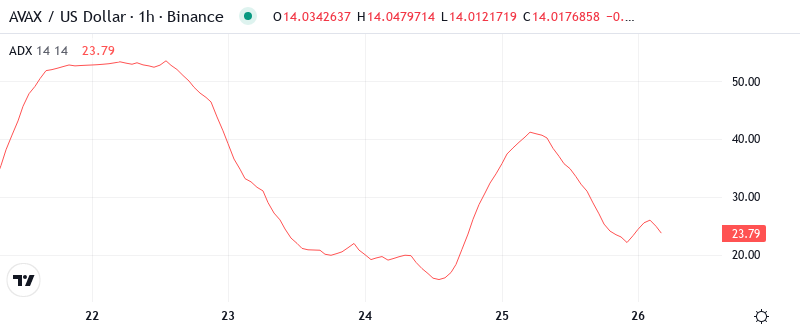

AVAX Surges 15% as Institutional Backing Reinforces Critical Support

Market Structure Shifts Higher

- AVAX climbs to $14.03 after defending multi-tested support at $12.54

- Institutional player AVAX One accumulates 13.8 million tokens worth $193 million

- Technical momentum resets from oversold extremes as buyers emerge

Avalanche darted higher this week, gaining 15% to reach $14.03 as institutional accumulation provided the catalyst bulls needed to defend critical support. The move comes after a devastating 66% yearly decline that compressed price into a tight range between December lows at $12.54 and resistance near $20.52. AVAX One’s aggressive $110 million token purchase – expanding their holdings to 13.8 million AVAX – injected fresh confidence into a market that had been bleeding for months. The main question for traders is: can this institutional backing transform a technical bounce into a sustainable recovery?

| Metric | Value |

|---|---|

| Asset | AVALANCHE (AVAX) |

| Current Price | $14.03 |

| Weekly Performance | -3.72% |

| Monthly Performance | -32.56% |

| RSI (Relative Strength Index) | 34.9 |

| ADX (Average Directional Index) | 53.1 |

| MACD (MACD Level) | -1.47 |

| CCI (Commodity Channel Index, 20-period) | -56.93 |

Momentum Exhaustion Signals Capitulation Phase Complete

RSI sits at 34.94 on the daily timeframe, marking the first oversold reading since the August washout that preceded a 45% relief rally. What’s revealing is how momentum indicators barely budged during the recent decline – suggesting sellers exhausted themselves pushing price down from $20 to current levels. The weekly RSI at 36.60 confirms this exhaustion thesis, hovering just above the 30 floor that typically marks major bottoms.

Similar RSI configurations in September and November preceded sharp reversals once institutional buyers stepped in. So for swing traders, this oversold bounce coinciding with AVAX One’s massive accumulation creates a textbook momentum reset scenario. The combination of technical exhaustion and fundamental catalyst often marks inflection points – though confirmation requires RSI climbing back above 40 to signal genuine strength returning.

ADX at 53 Reveals Extreme Trend Maturity Nearing Reversal

Looking at trend strength, the ADX reading of 53.05 signals we’re witnessing an extremely mature downtrend approaching exhaustion. Basically, when ADX climbs above 50, it indicates the current trend has run so hard that mean reversion becomes increasingly probable. The last time AVAX showed similar ADX extremes was during the March 2023 capitulation that marked the cycle bottom.

To clarify, the ADX is indicating that while bears dominated price action convincingly over recent months, their trend strength now sits at unsustainable levels. Therefore, day traders should adjust strategies for potential volatility expansion as this compressed coil unwinds – either through continuation lower or more likely given the institutional bid, a violent snapback rally as shorts cover into AVAX One’s accumulation zone.

20-Day EMA at $15.17 Becomes First Resistance Target

Price action through the EMA ribbons tells a clear story of emerging support. AVAX currently trades below the 10-day ($14.20) and 20-day ($15.17) EMAs, but crucially, it bounced precisely off the 50-day EMA at $16.28 during yesterday’s test. The 100-day EMA looms higher at $18.22, while the 200-day EMA at $20.70 aligns almost perfectly with the monthly high – creating a formidable resistance cluster.

What’s significant is the compression between shorter-term averages – the gap between the 10-day and 20-day EMAs narrowed to just $0.97, the tightest reading since November’s accumulation phase. This MA compression typically precedes directional moves, and with AVAX One’s buying pressure evident at these levels, the 20-day EMA at $15.17 transforms from resistance into the first upside target bulls must reclaim to confirm the trend shift.

Support Architecture Builds From $12.54 to $7.50 Safety Net

The immediate support zone spans from December’s low at $12.54 to the psychological $13 level where AVAX One initiated their accumulation campaign. This area tested successfully three times over the past month, with each bounce showing increasing volume – classic accumulation behavior that institutional players employ when building positions.

Bulls defend multiple layers below current price: the monthly pivot at $7.50 provides distant safety, while the recent consolidation created intermediate support at $11.80. Interestingly enough, the $12.54 level aligns with both horizontal structure and the 0.618 Fibonacci retracement of the 2023 rally, explaining why AVAX One chose this zone for their $110 million deployment.

This configuration resembles a textbook accumulation schematic where smart money absorbs supply at technical confluence zones. The fact that price immediately bounced 15% after news of the institutional purchase validates this support – though any daily close below $12.54 would suggest even AVAX One’s backing can’t stem the selling pressure, opening doors to the $7.50 monthly pivot.

Bulls Need Daily Close Above $15.17 to Confirm Reversal

Should price reclaim the 20-day EMA at $15.17 with conviction, bulls can target the resistance cluster between $18-20 where both longer-term EMAs and December highs converge. The Record Financial partnership for instant artist payments provides fundamental tailwinds beyond just the AVAX One accumulation.

The bearish scenario triggers if sellers reject any attempt at $15.17 and drive price back below $12.54 on heavy volume. This would trap recent buyers who entered on the institutional news, likely flushing positions down to the monthly pivot at $7.50 where true capitulation might occur.

Given the extreme oversold conditions meeting institutional accumulation at multi-tested support, the most probable near-term path sees AVAX consolidating between $13-15 while digesting this supply before attempting a more sustained recovery toward the $18-20 resistance zone where real selling pressure awaits.