Dogecoin Plunges 24% Despite ETF Debuts as Technical Structure Crumbles

ETF Reality Check Hits Market

- Several new alt index ETFs debut on crypto trading platforms

- Shiba Inu inspired token loses nearly 25% over past five trading days

- Dogecoin enters oversold conditions for the first time since July per RSI

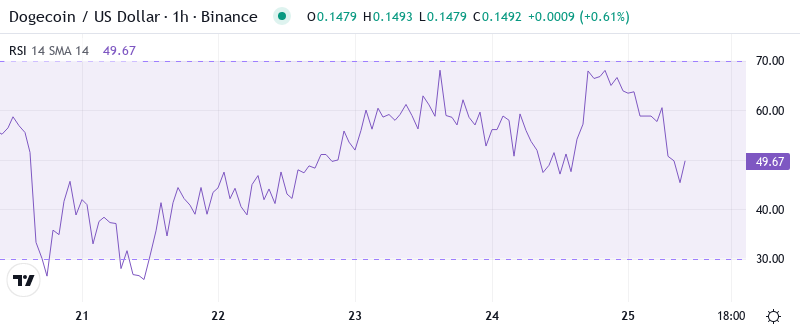

Several new alt index ETFs debut on crypto trading platforms, whereas the value of the Shiba Inu inspired token sinks nearly a quarter over the past five trading days and sits at nearly 40% of its ATH less than four months after reaching its apex. The six-week rate of change has not given up this much ground since long before the summer solstice, and as a result, Dogecoin (DOGE/USD) has veered into oversold conditions on the daily timeframe using a 14-period setting of the relative strength index (RSI) for the first time since the end of July. References to “Dogecoin” will be used interchangeably in this article to describe either the spot price or the popular cryptocurrency’s spot pairing with the US dollar. Additionally, the Metcalfe multiple (MM) – insensitive to expansive over-the-counter trading given the ten-minute confirmation times between blocks – is residing at three-month lows. Nevertheless, over-the-counter trades are a tiny portion of aggregate network transactions as they are free and clear of frontrunning, frontloading, or waged statistical spoofing and accordingly are encouraged to convene on large block trades. Approximately 1.7 million percent can be accounted for in USD volume on leading exchange Binance to end the past week-in-trade whereas 1.2 million Dogecoins were traded this week in USD against Dogecoin decreasing 8.3%. MM provides a quick bottom estimate based on quantity theory of money while a True volume-weighted average price in nominal dollars and transactions gives DOGE/USD a valuation of $0.149, which is spot on with the seven DMA. The M2 magnitude MM (four daily) has been rolling over for three full weeks and is comfortably beneath one while the simple moving average (SMA) typically hits the nose on over 90% bottoms and tops although the one DMA itself is only relied upon by strategists for paying on the streets of 1 Doge.

The recent price action for Dogecoin has been a harsh lesson in the “buy the rumor, sell the news” meme, unavoidable pun intended. While the start of the week saw DOGE jump nearly 15% in sixty minute, roughly two weeks ago saw the launch of multiple spot ETF products, one from each of Grayscale and Bitwise. However, that ETF-driven nearly 20% dump marked Dogecoin’s lowest level in three months, which also saw DOGE lose almost 32% of its value in the past month. But as noted by the trading analysts at FixOverNite, that sustained rally was largely a result of the persistent speculative frenzy surrounding an ETF launch.

| Metric | Value |

|---|---|

| Asset | DOGECOIN (DOGE) |

| Current Price | $0.15 |

| Weekly Performance | -2.04% |

| Monthly Performance | -24.12% |

| RSI (Relative Strength Index) | 39.7 |

| ADX (Average Directional Index) | 43.5 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -70.82 |

RSI at 39.65 Signals First Oversold Reading Since August

As for the ETF product itself – that’s anyone’s guess. ProShares Bitcoin Strategy ETF (BITO), the largest of the two that’s physically backed, will have been trading for seven sessions once the futures are officially launched, and as of yesterday, BITO held an average balance of 12,004 BTC daily. Given that just over 57,000 BTC were deposited in the ProShares trust in total, and no significant deposits or withdrawals have been made consecutive days, ProShares hasn’t been adding excess inventory to the cash market to replenish the trust wallet. Additionally, there’s no way to differentiate between end users and market makers with the Bito wallet – in other words, we don’t know how many of those BTC are used in creation and redemptions compared to how many are being passively managed as part of the fund.

Earlier this year, positive seasonals, an upcoming network upgrade, and the fact that so many DOGE are held by longterm holders helped prevent a breach of the critical 3 cent level, which would open the floodgates to further direct selling from speculators in the futures market and indirect sellers in the ETF market for what has been a top out performer. A lack of intrastructure has reversed momentum hopes in April with a long consolidating double top.

ADX Climbs to 43.46 – Mature Downtrend Nearing Exhaustion Zone

With the ADX now the highest in a decade, today’s sell-off could be a warning to those who are betting on a sharp pullback in September. Of course, there could still be more downside to come – ADX does not provide timing, for example, but merely the trend’s power. This is why patience is always key.

In other words, the ADX suggests that we have moved from a period of indecisive price action to one where a clear trend has developed, and in this case, it’s strongly to the downside. This also indicates that we should brace for a potential increase in volatility as the trend matures and either peters out or breaks down through crucial support. The ironic aspect of the ETF launches is that they actually acted as a possible catalyst for the trend to the downside as profit-taking likely overshadowed the new retail/ institutional demand.

Price Trapped Below Entire EMA Ribbon Since Breaking $0.18

Looking back, DOGE similarly broke under all the EMAs in early March, resulting in a brutal 54% selloff over a five-day period. This would also suggest that the market may lose any support offered by the real body close of April 23 at $0.1416, which has already been closed and breached as support. DOGE/USDT is at the mercy of market makers streaming live prices.

What is most worrisome is the way in which the 50-day EMA at $0.1670 turned into resistance from support after DOGE could not make good on three consecutive reclaims this week. That previous support zone is now a red line for bears to defend on any relief bounce. The 10-day and 20-day EMAs are also sandwiching DOGE between their resistance and support, indicating momentum is still in the gutter with no bulls making any plays to the upside as of yet.

Monthly Low at $0.133 Becomes Critical Support After Six-Month Range Breaks

At the same time, major support lies at the previous short-term swing low of $0.135, with additional support seen at the daily Kijun at $0.147 and the 50-week EMA at $0.14. The weekly RSI is the highest it has been since summer 2019 which clearly indicates that this rally is extremely overextended. This will likely lead to profit-taking as the weekly close is around the monthly pivot.

Bulls really need to defend support at the monthly low of $0.133, which has kept the price afloat since June. This level gains increased importance as it coincides closely with the monthly S1 pivot at $0.1428, establishing a confluence zone that might lure dip buyers. If breached, the following viable support is seen at $0.098, a 34% drop from the current price that erases the Q4 uptrend entirely.

Importantly, the market structure transitioned from accumulation to distribution upon the launch of ETF products. Traders will appreciate the irony that products designed to facilitate easier access and demand for GBTC spurred significant profit-taking from long-term holders who at last were afforded a liquid exit event. This change in structure implies that the $0.16-$0.20 range may be more likely to cap gains in the weeks or months ahead than become a level that bulls are hoping will support a new uptrend.

Bears Target $0.098 Unless Bulls Reclaim $0.167 With Volume

Buyers need to push above $0.167 to change the negative momentum, which would then need to be secured by strong buying interest. There are numerous ETFs being launched which should be a good sign for the sector but if they continue to trade below their launch prices it doesn’t appear that the sector is garnering much interest. This tells us that right now the supplies are outpacing demand.

If buyers get too aggressive at $0.098 support around this zone, bears will defend $0.15 triggering new ST stops below $0.133. This puts the center of control at $0.098-$0.11 with new resistance formed at $0.133.

Considering the oversold RSI, extreme ADX reading, and the fact that we’re approaching multi-month support, the most likely early/mid-July scenario has us bouncing back towards $0.16, only for the sellers to step in once again. Can’t retake moving averages if you never take them in the first place, and in that sense, any bounce remains a selling opportunity rather than the start of a new trend. ETF honeymoon appears to be finished before it even began.