Bittensor’s TAO Tumbles 26% Monthly as AI Narrative Loses Steam Despite New Platform Launch

Market Pulse

- TAO drops to $284.80, erasing one-quarter of its value in just 30 days

- Six-month performance shows devastating 36.5% decline from highs near $440

- Bitstarter crowdfunding platform launch fails to arrest the slide

Bittensor’s TAO has shed 26% over the past month, collapsing from $385 to $284.80 as the AI crypto narrative that once propelled it faces harsh reality checks. The decline accelerated despite November’s launch of Bitstarter, the ecosystem’s first dedicated crowdfunding platform, which traders hoped would inject fresh capital and momentum. The main question for traders is: can TAO find meaningful support before testing the psychological $250 level, or will the bearish momentum flush positions toward year-to-date lows?

| Metric | Value |

|---|---|

| Asset | BITTENSOR (TAO) |

| Current Price | $284.80 |

| Weekly Performance | -11.14% |

| Monthly Performance | -26.05% |

| RSI (Relative Strength Index) | 36.2 |

| ADX (Average Directional Index) | 25.6 |

| MACD (MACD Level) | -29.01 |

| CCI (Commodity Channel Index, 20-period) | -103.19 |

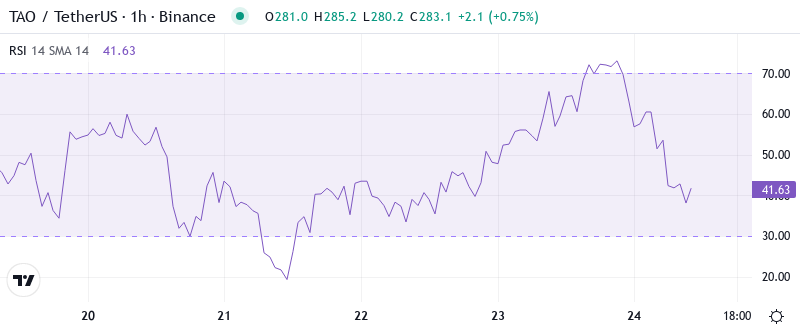

Momentum Exhaustion Signals Capitulation Phase – RSI at 36.15

RSI sits at 36.15 on the daily timeframe, marking the first approach toward oversold territory since the August washout that preceded a 40% relief rally. The oscillator’s descent from neutral readings above 50 just weeks ago tells a story of rapid sentiment deterioration, with sellers overwhelming any attempt at stabilization despite the Bitstarter platform going live with its first investment rounds.

What’s revealing is how RSI behaved during the decline – no meaningful bounces or divergences formed, suggesting genuine selling pressure rather than temporary profit-taking. So for swing traders, this momentum exhaustion near oversold levels presents a double-edged sword: while a technical bounce becomes probable below RSI 30, the absence of positive divergence warns that any rally might prove short-lived without fresh catalysts beyond crowdfunding initiatives.

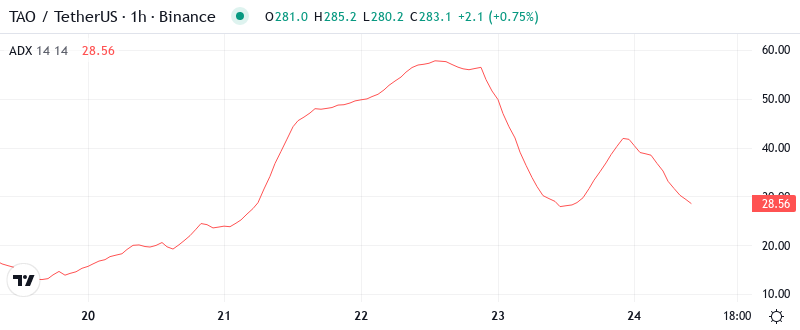

ADX at 25.55 Confirms Bears Control the Trending Move

Looking at trend strength, the ADX reading of 25.55 indicates TAO has shifted from November’s choppy consolidation into a defined downtrend. The indicator crossed above 25 just as price broke below the critical $340 support level, confirming that the selling pressure carries conviction rather than representing mere noise.

Basically, this ADX configuration tells day traders that fade-the-rally strategies remain optimal until the indicator drops back below 20 or price reclaims key moving averages. The trending conditions mean that counter-trend positions require tight stops, as the market has shown little mercy to dip buyers attempting to catch this falling knife even with positive developments like Deutsche Digital Assets’ ETP approval on Nasdaq Stockholm failing to stem the bleeding.

50-Day EMA at $346.64 Now Caps Any Relief Rally Attempts

Price action through the EMA ribbons paints a bearish picture, with TAO trading decisively below all major moving averages. The 10-day EMA at $307.23 provided brief support during early December before giving way, while the 20-day at $332.74 and 50-day at $346.64 now stack overhead as resistance layers that bulls must reclaim to shift the narrative.

Most telling is the compression between the 100-day EMA at $356.76 and 200-day at $360.71 – this convergence typically precedes significant moves, though with price trading $75 below these levels, the resolution appears bearish. That former support cluster between $346-$360 transforms into a formidable ceiling, requiring sustained buying pressure that current market conditions haven’t demonstrated despite Chainlink joining TAO-related initiatives as a strategic advisor.

Multiple Resistance Zones Stack Between $307 and $383 Overhead

Above current levels, sellers have fortified positions at multiple technical confluences. The immediate resistance begins at the 10-day EMA near $307, followed by the psychological $320 level where trapped longs from the recent breakdown likely await exits. The major resistance zone extends from the 50-day EMA at $346.64 through the 100/200-day EMA convergence near $357-$360, with December’s failed breakout high at $383.60 marking the upper boundary of overhead supply.

Bulls defend support at the monthly pivot S1 level of $248.73, which aligns with August’s major low and represents the final defense before potentially testing the yearly pivot at $67.93 – though that extreme target seems unlikely without a broader crypto market collapse. The $250-$260 zone has historically attracted institutional accumulation, evidenced by multiple bounces throughout 2024’s volatile swings.

Crucially, the market structure signals sustained bearish pressure as long as TAO remains below the $346.64 level on any relief bounce. The failure to hold above $340 after positive news flow including the Bitstarter launch and institutional ETP developments suggests fundamental headwinds outweigh technical support levels for now.

Bears Target $248 as Bulls Require Volume Surge Above $346

Should TAO mount a recovery, bulls need a daily close above $346.64 with expanding volume to neutralize the bearish structure. Such a move would target the $360-$383 resistance cluster, though sustained momentum requires fresh narratives beyond current ecosystem developments to attract sidelined capital back into AI-focused cryptocurrencies.

The bearish scenario accelerates if price fails to hold the psychological $280 level on any retest, opening a direct path to $248.73 where the monthly S1 pivot awaits. A breakdown there would likely trigger capitulation toward $200-$220, potentially flushing out remaining leveraged positions and setting up a longer-term bottom.

Given the persistent selling pressure despite positive ecosystem developments and the ADX confirming trending conditions, the most probable near-term path sees TAO grinding lower toward the $248-$260 support zone before any sustainable bounce materializes. Risk-conscious traders should wait for either a confirmed support test or moving average reclaim before considering long positions.