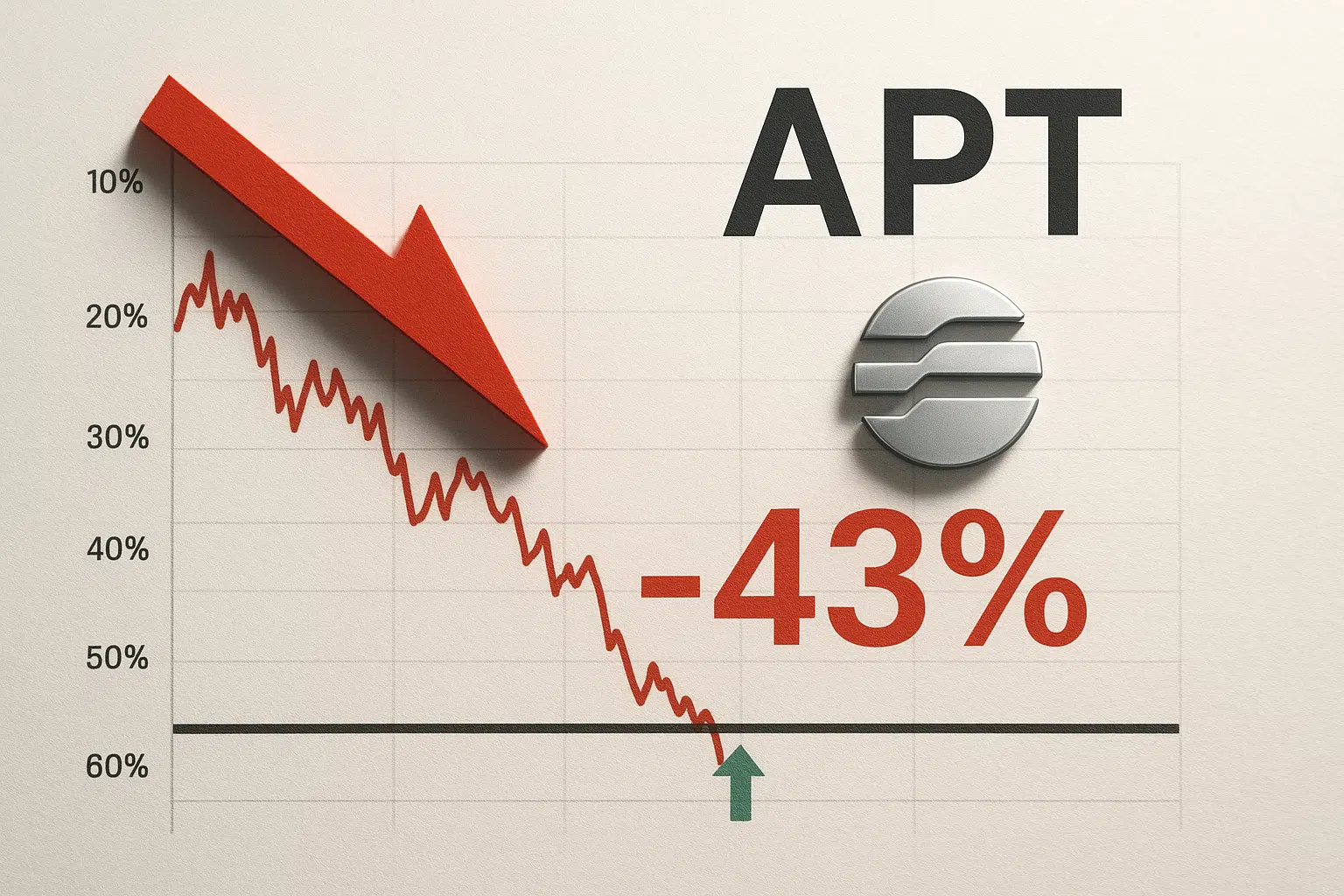

APT Tests Critical Support After 43% Monthly Plunge as Stablecoin Integration Offers Hope

Market Structure Shifts Lower

- APT tumbles 43.94% this month, testing multi-month lows near $2.69

- Paxos USDG0 stablecoin launch brings fresh utility to struggling Aptos ecosystem

- Technical indicators flash oversold but momentum remains decisively bearish

Aptos has endured a devastating drop of 43.94% over the past month, with price action collapsing from $4.70 to current levels at $2.69 as broader crypto markets turned risk-off and APT-specific selling intensified. The token shed nearly 17% in just the past week alone, erasing months of gains despite the arrival of Paxos Labs’ USDG0 stablecoin infrastructure – a development that would typically provide wind to the sails for any Layer 1 ecosystem. The main question for traders is: can this stablecoin integration provide enough fundamental support to halt the bleeding, or will technical weakness drag APT toward the psychological $2.00 level?

| Metric | Value |

|---|---|

| Asset | APTOS (APT) |

| Current Price | $2.69 |

| Weekly Performance | -9.20% |

| Monthly Performance | -16.56% |

| RSI (Relative Strength Index) | 37.4 |

| ADX (Average Directional Index) | 37.2 |

| MACD (MACD Level) | -0.17 |

| CCI (Commodity Channel Index, 20-period) | -86.37 |

Momentum Exhaustion Hits Extreme at 37.40 – Matches Historical Bounce Zones

RSI sits at 37.40 on the daily timeframe, marking the first venture into oversold territory since the August washout that preceded a 65% relief rally. What’s revealing is how rapidly momentum collapsed – from neutral readings above 50 just two weeks ago to current oversold extremes, suggesting panic selling rather than orderly profit-taking.

Similar RSI configurations in September and November both resulted in sharp bounces of 20-30% within days, though those reversals came with higher volume and clearer support levels intact. So for swing traders, this oversold reading presents a high-risk, high-reward setup where any stabilization could trigger a violent snapback rally, but failure to hold $2.69 would likely flush positions toward $2.00 where stronger historical support waits.

ADX at 37.18 Confirms Mature Downtrend Nearing Potential Exhaustion

Looking at trend strength, the ADX reading of 37.18 indicates we’re deep into a directional move with real conviction behind the selling. Basically, when ADX climbs above 35, it often signals that the prevailing trend – in this case bearish – has reached a mature stage where exhaustion becomes probable.

To clarify, the ADX is indicating that while sellers maintain control, the intensity of this downtrend rivals previous capitulation events in APT’s history. Therefore, day traders should prepare for either a sharp reversal as shorts cover or one final flush lower before the trend exhausts – with the USDG0 integration potentially serving as the fundamental catalyst to shift sentiment once technical selling subsides.

Price Trapped Below Entire EMA Ribbon Since Mid-December

Price action tells a brutal story through the EMA structure. APT currently trades well below all major moving averages – the 10-day ($2.98), 20-day ($3.11), 50-day ($3.36), and 200-day ($4.46) – creating a bearish stack that typically accompanies extended downtrends. The 50-day EMA, which provided reliable support throughout October and November, flipped to resistance after December’s breakdown and has capped every relief attempt since.

Most concerning for bulls is the compression between the 10-day and 20-day EMAs above current price, forming a resistance cluster between $2.98-$3.11 that APT must reclaim to signal any meaningful trend change. That former support zone now transforms into a red line for bears to defend – and with the USDG0 launch failing to spark immediate buying, technical traders remain firmly in control of price discovery.

Support Architecture Crumbles as $2.69 Becomes Last Defense Before $2.00

Resistance stacks heavy across multiple levels, with the immediate ceiling at $3.18 where December’s breakdown point meets the monthly pivot. Above that, sellers have fortified positions at $3.51 (November low turned resistance) and the psychological $4.00 level that capped the last recovery attempt. Each failed rally has attracted fresh selling, creating a descending triangle pattern that targets $2.20 on a measured move basis.

The support structure looks increasingly fragile after multiple levels failed in rapid succession. Bulls now defend their final stronghold at $2.69 – a level that held during October’s correction but shows weakening buying interest with each retest. Volume has declined on recent bounces, suggesting exhausted dip-buyers despite the USDG0 utility upgrade.

This configuration resembles a market searching for a final capitulation low, where the fundamental improvement from stablecoin integration battles against overwhelming technical damage. The next 48 hours prove critical – either buyers step in with conviction to defend $2.69, or price discovery continues toward the $2.00 psychological level where stronger historical support from 2023 awaits.

Bulls Need Immediate Reclaim Above $3.00 to Avoid Deeper Flush

Bulls require a decisive close above the $2.98-$3.11 resistance cluster to confirm any bottom formation, with follow-through above $3.36 (50-day EMA) needed to shift medium-term momentum. The USDG0 ecosystem development provides the fundamental catalyst, but technical buyers need to see price action confirm the narrative with a clear reversal pattern and volume expansion.

The bearish scenario accelerates if APT loses $2.69 support on a daily close, which would trigger stop-losses from late dip-buyers and open an air pocket toward $2.00. Such a move would trap investors who bought the stablecoin news, potentially creating a final capitulation event where long-term holders throw in the towel.

Given the oversold conditions, mature downtrend signals, and arrival of meaningful fundamental improvements via USDG0 integration, the most probable near-term path sees APT attempting a relief bounce toward $3.00-$3.20 resistance before sellers reemerge. However, any sustainable recovery requires both technical repair work and tangible adoption metrics from the new stablecoin infrastructure to shift the narrative from “falling knife” to “value opportunity.”