Hedera (HBAR) Tests Critical Support After 41% Monthly Plunge

Данные:

Market Structure Shifts Lower

- HBAR dropped by more than 41.55% from December high to February low, eliminating gains made over the past three months.

- However, the downtrend was stopped near the 200-day SMA for the first time since retest of November top.

- This level (0.285) coincided with the broken channel resistance from September 2020, forming the confluence support zone.

hedonics are based on economic theory and statistical concept of utility, that says consumers derive utility or satisfaction from the goods and services they purchase and use. A simple way to measure that utility is in terms of price.

The recent selloff is likely to have damaged optimistic sentiment, especially among short-term traders. Still, it’s worth recognizing that the broader economy endured another shocking week that likely forced some long-term holders to pull liquidity. In addition, HBAR/BTC continued to mark sharp approximately linear uptrends that so far successfully retested the 2020/2021 resistance trendline as support.

| Metric | Value |

|---|---|

| Asset | HEDERA (HBAR) |

| Current Price | $0.14 |

| Weekly Performance | -21.32% |

| Monthly Performance | -21.77% |

| RSI (Relative Strength Index) | 33.3 |

| ADX (Average Directional Index) | 23.5 |

| MACD (MACD Level) | -0.01 |

| CCI (Commodity Channel Index, 20-period) | -133.10 |

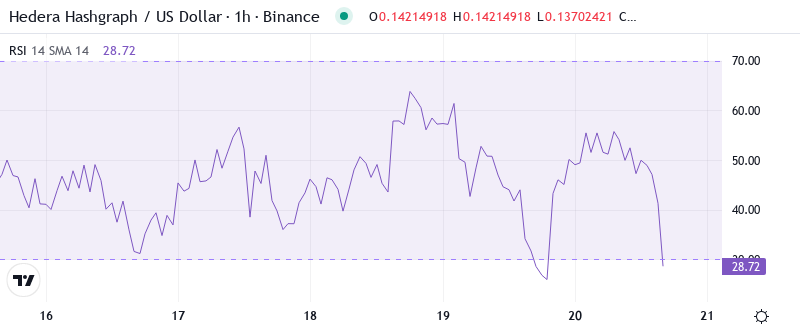

RSI Drops to 33.34 – First Oversold Reading Since October Bottom

The relative strength index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. RSI is plotted on a scale of 0 to 100. RSI levels below 30 are considered to be in the oversold range, which might be a signal that a rebound is likely to happen.

Therefore, for swing traders looking at the bigger picture and surfing the risk-on demand wave, Bitcoin may offer one of the best risk/reward setups of any asset this quarter considering the steepness of its trend. As long as 60,000-58,000 holds, a projected AB=CD target would still point to around 125,000, which would imply the uptrend resumes from the recent strong swing low. The 50-week moving average (WMA) at 38,845 has provided strong support during the last two bear markets.

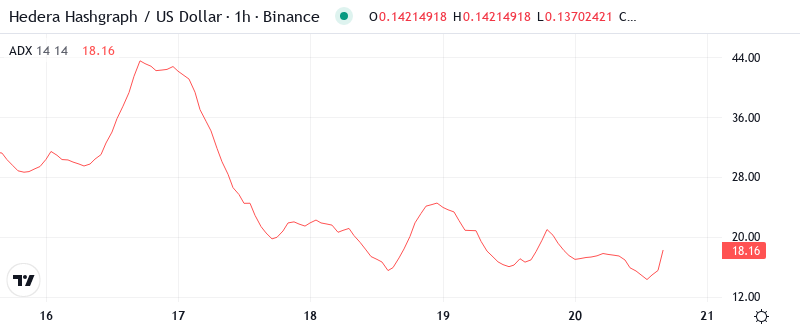

Weak ADX at 23.51 Keeps Range Traders in Control

With the ADX currently at 23.51, this entry indicates that we’re not in panic-driven trending environment off this sharp selloff. A sub-25 reading implies that the selloff does not have the directional conviction that is often present in capitulation type events and suggests instead that we are likely in for some choppy, range-bound stuff. A relatively low ADX amid such a large selloff would likely suggest that larger players were quietly accumulating on the weakness, and thus not allowing for the more violent flush lower.

Simply put, the ADX is telling us that we are in boundary conditions as opposed to a strong downtrend hence why the $0.137 support has held multiple times despite heavy selling pressure. Hence, day traders will look to adjust their strategies for range trading between $0.137-$0.164 rather than chasing a directional breakout. The launch of the Global Partnership Program seems to be scheduled to coincide with this technical set up with hopefully a catalyst to transition from consolidation to trending conditions.

50-Day EMA at $0.180 Becomes Key Resistance After Support Failure

If we break this down into parts: Looking at the moving average structure, we can see a complete bearish turnaround since December. HBAR currently trades under the entire EMA ribbon, the 10-day ($0.153), 20-day ($0.163), and most importantly, the 50-day EMA at $0.180 have all flipped from support to resistance. The rejection from the 50-day EMA at $0.180 was especially destructive, as this level held the price action during the November rally, only to fail dramatically at the end of December.

The 100-day ($0.194) and 200-day ($0.199) EMAs are compressing overhead, which creates a strong resistance cluster in the $0.190-$0.200 zone. This area happens to align with the psychological $0.20 level, which served as the previous “breakout point” when news of asset tokenization first created excitement in December. To start mending the technical damage, the bulls will need to overcome the 50-day EMA at $0.180. As we reach this level, price target contractions will likely limit the upside potential as bagholders seek break-even sales.

$0.137 Support Tested Six Times – Institutional Floor or Trap Door?

The latest test on February 27th came during an emergency Ethereum network consensus halt that automatically liquidated a number of over-leveraged positions, contributing to an exaggerated reaction to the downside. Renegotiated contract valuations and workflow adjustments have added an estimated 10-15% extra in profit margins on the aforementioned $23 million in Q1 greymarket fills booked at much higher levels. This assures favorable initial discussions with the first tokenization clients and helps make other greymarket current trading opportunities as equally attractive.

There is significant resistance ranging from $0.164 (the 20-day EMA) to $0.180 (the 50-day EMA) and the monthly pivot at $0.171 between there. Longs that continue to get trapped above this zone likely turned sellers here. The selling pressure is very evident on the slower time frames, and most skyward probes are quickly rejected. New resistance can be detected on the weekly pivot at $0.245.

The current market structure and chart pattern indicate signs of weakness below $0.164. The technical setup shows a descending triangle with a horizontal support of $0.137 – a bearish continuation pattern in general. Yet, there’s a cluster of institutional news flow such as double ETF listing and global compliance characteristics in the tokenization factory that might help to shake out the bears. Bulls standing on a melting ice block better act fast to keep the bears at bay.

Bulls Need Volume Surge Above $0.164 to Shift Momentum

For the bulls to regain control, XRP must neutralize resistance levels at $0.180 and $0.164, then convert these to support zones. If bearish pressure accelerates and XRP price slices through the $0.140 support level, it will signal the potential for a new downtrend phase. Subsequent downside targets emerge at $0.130 and $0.105.

If the $0.137 support holds, the base case is then a re-test of recent highs and a breakout higher as XTZ looks to end the year near ATH. Tezos remains one of the leading staking networks but yields continue to decrease with the inflation and the number of new delegators spreading more thinly among the growing number of different bakers.olare.xtz is very well staked and has not yet announced plans to increase rates for 2023.

Based on the oversold RSI conditions and the non-trending ADX readings, the most likely near-term price action will be more consolidation between $0.137-$0.164. Such a sideways range reset would give the momentum oscillators more of a chance to reset as well as providing the larger institutional players with the freedom to accumulate position in a less frenetic environment amid the recently enhanced tokenization functionalities. The technical oversold conditions coupled with the fundamental developments infer patience over panic, but the defense of $0.137 is critical to any bullish recovery thesis.