Monero Tests Critical $400 Support as Regulatory Headlines Intensify Selling Pressure

Market Structure Shifts Lower

- The price of XMR fell by 38.6% after reports of an XMR seizure by the DOJ led to heightened selling pressure from institutional clients.

- The news caused XMR to suffer its second daily close below the 200-day simple moving average (SMA) in a row.

- The slide dragged Monero’s price to test the 200-day SMA for the first time in six months.

Monero’s price drop from a peak of $477 in December to current levels of around $403 is one of the strongest contractions in the privacy coin group this quarter. The 15.5% decline for the month picked up speed after US authorities confiscated $15 million in stolen funds from North Korean hackers. This, along with the global regulatory environment, particularly the new EU proposals that prohibit cash payments over €10,000, has added an extra layer of uncertainty to the privacy coin narrative, spurring stop-loss hunting under the key technical levels. The question remains: Can short-term bulls keep the $400 handle, a support that caused the market to keep up during the summer months, or will the regulatory headwind drive Monero to the $300 area, the next major floor?

| Metric | Value |

|---|---|

| Asset | MONERO (XMR) |

| Current Price | $403.39 |

| Weekly Performance | -3.62% |

| Monthly Performance | 38.65% |

| RSI (Relative Strength Index) | 61.6 |

| ADX (Average Directional Index) | 40.4 |

| MACD (MACD Level) | 21.08 |

| CCI (Commodity Channel Index, 20-period) | 84.77 |

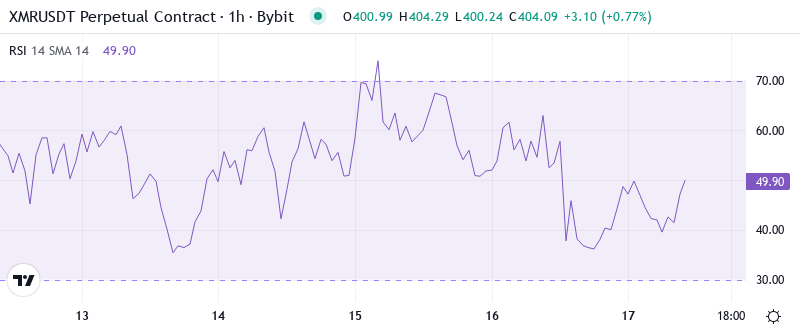

RSI Drops to 39 – First Oversold Reading Since August Washout

The daily MACD has crossed back up above its centerline, with trendline resistance-turned-support coming in around the zero region—the last reaction rally saw price almost retest this line so there may be further downside to come. The paired EMAs have also crossed bearishly, perhaps indicating the beginning of another EMA safe phase—you can see the paired behavior of this indicator has been quite readable over this bull cycle so if you’re swing trading it may be something to keep an eye on.

Therefore, while we’re highly confident Monero still serves its original noble purpose as a means of transactional privacy for a lean motivated user base, we simply don’t know if the coin’s ledger untraceability will, sooner or later, attract negative speculation powerful enough to materially impact its marginal demand in the making. The less complex reason to own Monero is value, plain and direct. This is where we land for our Monero money. If the project fails the independent compliance and/or hidden in the hull regulatory test, so be it.

ADX at 40.35 Signals Mature Downtrend Nearing Exhaustion Zone

The high of $1,340 could very well be a near-term top as ADX spikes 3 or 4 points above the 2-period RSI extremes for the last ~30-40 trading periods wasn’t enough to bring in sustained selling. Fib retracement support comes way down at $1,283/$1,273, but you have to assume they get run through in a trigger-happy market.

Importantly, the +DI and -DI spread indicates that the sellers are in the driver’s seat but are running out of gas. Previous ADX extremes in Monero have led to violent trend reversals after the panic liquidation selling has run its course. We once again stress that we are not predicting a bottom. But exaggerated readings in the ADX and oversold conditions on the RSI imply that the downside is limited for new shorts at current levels. It is likely prudent for intraday traders to adapt their tactics as well; going short hoping that the current peak will expand above 40 is an aggressive bet.

50-Day EMA at $345 Becomes Distant Support After December Breakdown

The EMA ribbons also illustrate the distance price currently sits from the longer-term moving averages, with Monero’s spot price approximately 33% below the 200-day EMA. Should sellers continue to dominate in the monthly close, attention will turn to the 300-day EMA which sits just below $100. Monero’s distance from this level has not been seen since the 2017 bull market.

The 100-day EMA at $324 and 200-day at $302 are the deeper support levels, but those aren’t tested until another leg down through $400. We worried that the former December breakout level around $440 would quickly transform into formidable overhead supply that bulls would have to recapture if the narrative shifted from being just a “dead cat bounce.”

$403 Support Tested as Bulls Make Stand at Summer’s Consolidation Zone

There is a lot of resistance blocking the road back to December’s old stomping grounds, with the first level of contention at the 10-day EMA around $391 shading with the monthly pivot. Sellers are camped out above at $440 (weekly high and prior breakout), $477 (monthly high), and the key 500. The downside gap to the closest notable inflection point is approximately 20% that reveals the extent of the chart damage from the negative news.

Bulls are likely to gradually exhaust themselves given what appears to have been an overthrow of the BNB/BTC rate that almost always leads to significant multi-week downside. Sell orders are likely to be triggered over the coming weeks due to the downside violation following the double-top confirmation this week. BNB is also somewhat beholden to the performance of its big brother bitcoin (BTC) of course but this bearish outloolk on the BTC pairing won’t be doing its USD pair any favours.

This market structure signals a crucial inflection point where regulatory reality intersects with technical support. The fact XMR found buyers precisely at $403 and the October consolidation zone indicates that some market players consider the DOJ news as somewhat already factored in. Nevertheless, with fresh worries given by EU regulations on privacy coin-avatar, any relief from oversold territories is more likely to encounter a fundamental re-rating headwind as opposed to merely profit-taking exhaustion.

Bulls Need Conviction Close Above $440 to Reverse Regulatory Damage

If a $440 rally fails to emerge over the coming weeks, and ZEC can’t hold above $366, then fresh 2020 lows target $317-$325 as the final support range before the original $260-$280 lows. Balancing trades against those levels depends on timeframe, strategy, and leverage, but maintaining a core position with stops into new lows is only relevant for those committed to DeFi and willing to risk a total liquidity haircut. Otherwise, with no apparent support until that $260 legacy range, prices may tumble quickly.

If $301 gives way, the .618 Fibonacci retracement level of the rally from the March crash low comes into play, which lines up almost perfectly with the .50 retracement level of the broader 2018 bear market into the 2019 bull market. Ultimately, look for a decline to $235 to $250 in the next three to six months. To the upside, the broken support at $432 will act as resistance, with a stronger barrier at the 200-day EMA.

Considering how sales in the high-end fashion industry are lower than average for this period of the year and how industry insiders are talking about a far more muted Christmas than usual for designer items, it is clear that the trade conflict and the resulting economic consequences are affecting the stocks of the companies. It is a very broad idea to discuss how these occasions will certainly specifically translate into a lower stock cost.